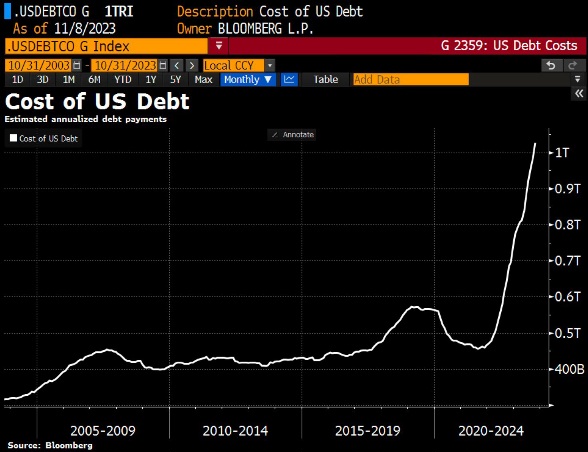

The recent news that the US government has passed the $1 trillion mark for interest payments on its debt has sparked concern among economists and financial experts. The fact that the total interest payment will likely reach $2 trillion in just a year’s time has led some to sound the alarm, with one analyst proclaiming, “The end is near!” This dire prediction is reminiscent of the oft-seen signs held by street corners prophets warning of an impending apocalypse.

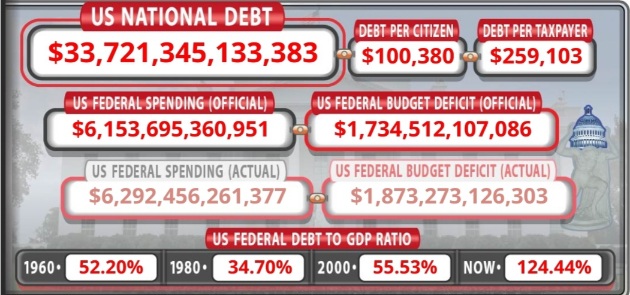

The issue at hand is the ballooning national debt, which currently stands at over $33 trillion. As interest rates rise, the cost of servicing this debt becomes increasingly burdensome, leading to a vicious cycle where more debt must be taken on to pay off existing obligations. This situation has led some to question the long-term sustainability of the US economy and the value of the dollar.

Governments usually default through hyperinflation, as they lack the courage to cut spending supported by their donors. Hyperinflation becomes their only way out, as it allows them to print more money and pay off their debts with devalued currency.

The U.S. National Debt Clock, which displays the rapidly increasing national debt in real-time, paint a dire picture of the country’s financial state. By examining the clock, it’s clear that drastic measures need to be taken to address the issue before it’s too late.

It’s truly sad for the new generation, who will inherit the consequences of years of reckless spending and monetary policy. At least we had it nice for a while, but now it’s time to face the music. One thing is certain – the purchasing power of fiat currencies will continue to decline, and the dollar will likely join the ranks of other failed currencies throughout history. But all is not lost. There is a way to protect your wealth during these uncertain times: Bitcoin.

Unlike fiat currencies, which are subject to the whims of central banks and governments, Bitcoin is decentralized and has a fixed supply. Its value isn’t determined by a small group of elites, but rather by the market forces of supply and demand. And because it’s not tied to any particular country or economy, it’s not susceptible to the same risks as traditional investments.

Its decentralized nature allows for peer-to-peer transactions without the need for intermediaries, making it an attractive option for those looking to hedge against inflation and economic uncertainty.

In light of these developments, it’s worth considering the wisdom of diversifying one’s portfolio with assets like Bitcoin. While it’s impossible to predict exactly how things will play out, having a Plan B in place can help mitigate risk and ensure financial resilience in turbulent times. As the saying goes, “Don’t put all your eggs in one basket.” Diversification can provide peace of mind and protect wealth in a world where the value of traditional currencies seems increasingly uncertain.

It’s worth noting that Bitcoin has had its own share of volatility, and its price movements can be unpredictable. However, its decentralized nature and limited supply make it fundamentally different from traditional currencies, which are subject to the whims of governments and central banks. Investing in Bitcoin requires careful consideration and a solid understanding of the risks involved. But for those who believe in its potential, it may serve as a valuable hedge against the unknowns of the future.

As we move forward, keeping a close eye on both domestic and global economic trends will be crucial. The US government’s growing interest payment burden is just one of many factors signaling a potentially tumultuous road ahead. By staying informed and prepared, individuals can take steps to safeguard their financial well-being, whether through traditional means or innovative alternatives like Bitcoin.