Bitcoin has been experiencing some volatility lately, with a noticeable downturn occurring amidst shifting expectations for Federal Reserve (Fed) interest rate decisions. Let’s dive into the details behind this fluctuation and examine how changing probabilities for Fed rate cuts could impact Bitcoin’s future performance.

Fluctuations Triggered by Shifting Probabilities for Fed Rate Cuts

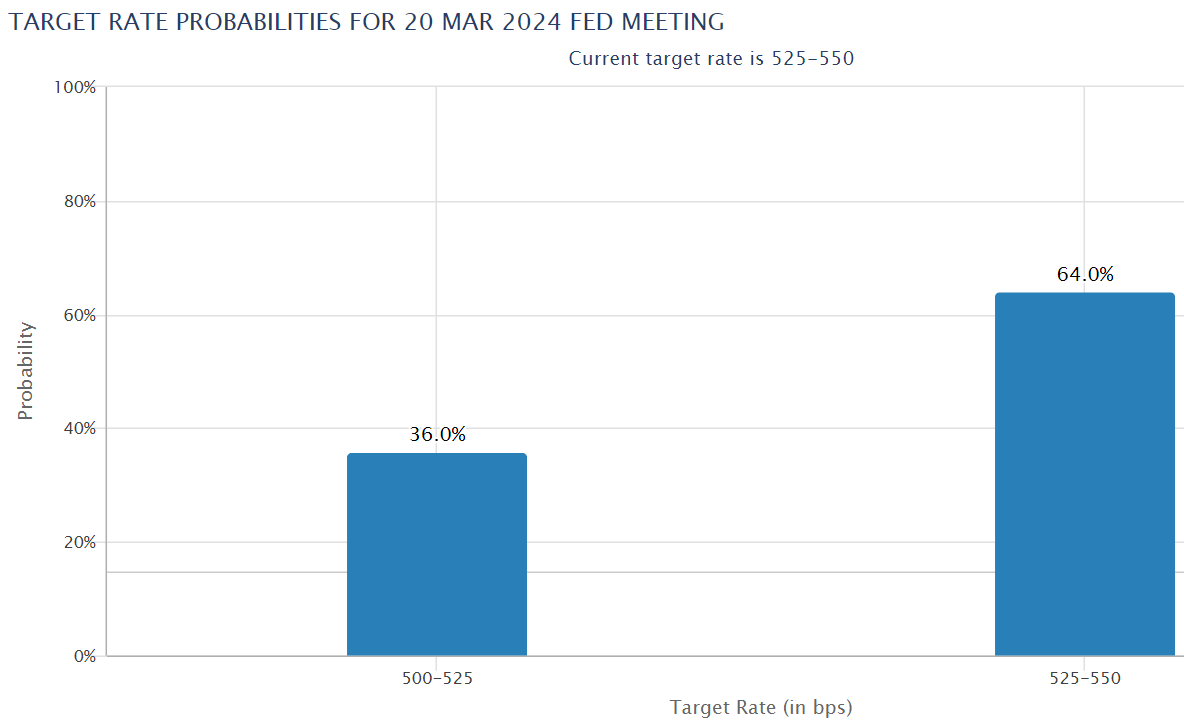

Recently, traders had scaled back their wagers regarding a possible Fed rate cut in March. According to data from the Chicago Mercantile Exchange (CME), the likelihood of a 25 basis point reduction in March dropped significantly – falling from approximately 90% just a month prior to around 35.5%, which contributed to the decrease in Bitcoin’s price. This shift in outlook caused uncertainty among traders, resulting in profit-taking behavior and selling pressure, thereby intensifying the downward trend for Bitcoin.

Market Sentiment for Future Interest Rate Decisions

Despite the reduced probability for an imminent rate cut in March, predictions remain optimistic for reductions later in the year. Markets now indicate a 62.9% likelihood of a 25 basis point cut taking place in May, reflecting increased confidence compared to levels earlier in the week. Furthermore, the chances of a more aggressive half percentage point reduction by May stand at roughly 32%, representing a significant portion of overall market speculation.

How Could Inflation Impact Bitcoin?

If the Fed encounters unexpectedly elevated inflationary pressures, we can anticipate several consequences for Bitcoin. Due to its limited supply cap of 21 million coins, the cryptocurrency often acts as an effective hedge against increasing prices, thus potentially benefiting from inflation surges. Investors looking for safe havens to protect themselves from declining fiat values might find solace in Bitcoin, consequently fueling demand and raising its worth.

Conclusion

While short-term uncertainty arising from modified forecasts for Fed interest rate adjustments has temporarily affected Bitcoin’s valuation, long-term prospects appear promising. Economists generally expect that looser monetary policies accompanied by lower interest rates will ultimately support both conventional asset categories like equities, fixed income securities, and precious metals along with emerging financial tools like digital currencies. By understanding current events and underlying factors influencing the ever-changing world of finance, savvy investors stay well-informed and prepared to make educated investment choices.

Understanding the Current Dip in Bitcoin Price Amid Changing Expectations for Fed Rate Cuts