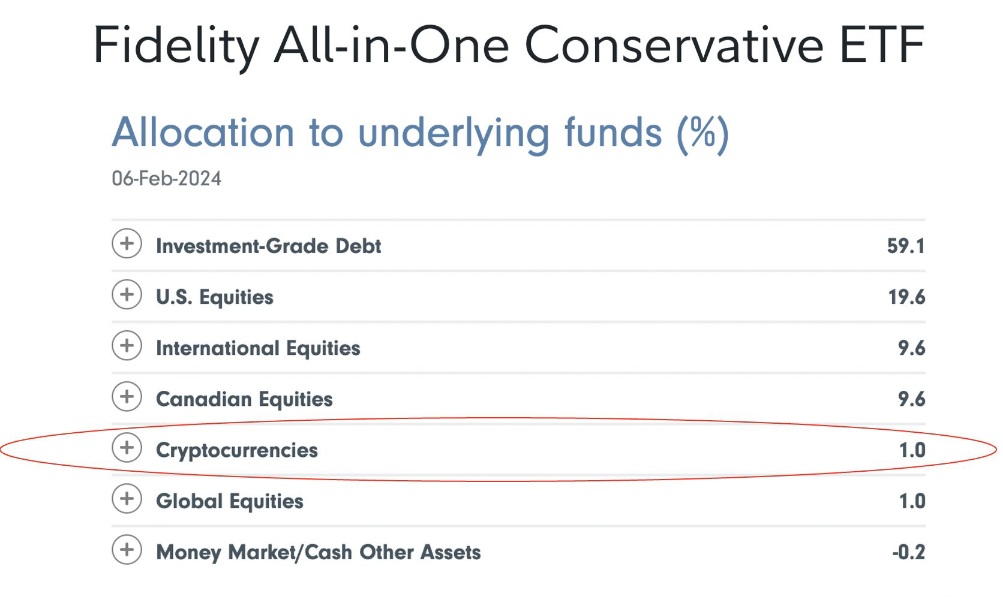

Fidelity Investments Canada recently announced an intriguing addition to some of their “All-in-One ETFs” asset allocation funds, which could signal a positive trend for cryptocurrency adoption within traditional finance. Starting soon, both the Conservative and Equity versions of these funds will allocate portions of their assets to Bitcoin. In fact, the Equity portfolio includes a 3% allocation, while the more cautious Conservative portfolio holds 1%.

Get strategic exposure to crypto (1–3%, depending on the fund) for added diversification. Keeping a small allocation to crypto in your portfolio can give you the potential for higher returns and serve as a hedge against traditional markets.

Fidelity All-in-One ETFs

Although the initial investment amounts may appear modest, with combined Bitcoin holdings totaling roughly $20 million CAD across all three ETFs, this decision marks a significant milestone in mainstream recognition of digital currencies.

This development comes after years of skepticism from many financial institutions; however, it seems we are finally approaching the cusp of widespread crypto acceptance. With large firms incorporating digital currencies into their models, it creates a potentially legitimate demand source for blockchain-based assets. Moreover, considering the historical performance of Bitcoin compared to other investments, including it in well-diversified portfolios makes sense for those seeking long-term growth opportunities.

Given that Bitcoin has outperformed most major asset classes consistently throughout the last decade, the reluctance towards embracing this revolutionary technology appears puzzling. Nevertheless, recent developments indicate a shift in institutional thinking.

As more organizations recognize Bitcoin’s value proposition, they begin integrating it into existing infrastructure, creating what I refer to as the ‘Second Big Bang of Bitcoin.’

Consider the ripple effect generated by numerous entities adopting Bitcoin en masse: pension funds, endowment foundations, family offices, hedge funds, retail brokerages, RIAs, and individual advisors. Each entity represents additional buy orders, pushing up prices further and generating even greater interest. Consequently, this cycle results in a self-reinforcing loop known as a ‘demand shock‘, fueling exponential appreciation of Bitcoin.

In conclusion, the gradual but steady entry of institutional capital into the world of cryptocurrency hints at a paradigm shift underway. We find ourselves standing on the precipice of another transformational era reminiscent of the late 90s internet boom.

Those who embrace this change stand to benefit significantly, whereas others might struggle to adapt or face obsolescence altogether.