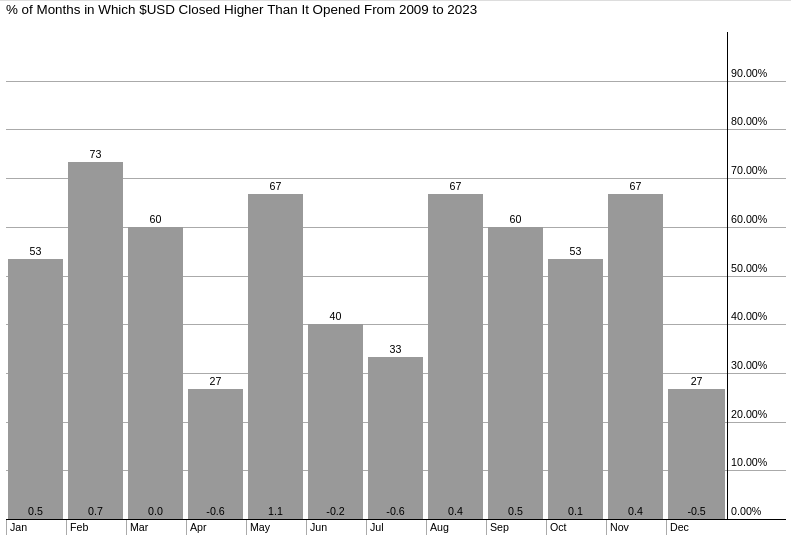

The US Dollar is known for its strength and stability in global markets, but did you know that there are specific months when it historically performs better than others? According to our analysis, February has been one such month, exhibiting consistent gains since 2009. In fact, the trend suggests that investing in the dollar during this period can yield significant returns.

From 2009 to 2023, we have seen that the US Dollar index futures continuous contract (DX) rose 73% of the time between January 11th and February 25th, resulting in an impressive total return of 16.11% over the last decade. On average, investors could expect a gain of 0.7% during these two months alone!

However, before diving into any investment decision, it’s crucial to consider certain factors. While history may provide valuable insights, it does not assure similar outcomes in the future. Therefore, while the potential rewards look promising, they also come with inherent risks associated with financial investments. As such, thorough research and careful planning should underpin every investor’s approach.

It’s worth noting that various elements influence currency values; geopolitical events, economic indicators, monetary policies, among others, all play their part in shaping market dynamics. Thus, staying informed about current affairs related to the US economy becomes essential when considering an investment strategy centered around the US dollar.

Moreover, diversification remains key to managing risk effectively. Spreading your assets across different types of securities or asset classes can help mitigate losses caused by adverse movements in any single investment. This principle applies regardless of which particular security or sector piques your interest at a given moment.

In conclusion, February has proven itself as a potentially profitable month for the USD within the studied timeframe. Nevertheless, remember that no investment strategy guarantees success, especially without proper due diligence and strategic planning. Stay updated on relevant news, maintain a well-diversified portfolio, and consult with a financial advisor if necessary – these steps will ensure you make informed decisions backed by sound judgment rather than speculation alone.

Happy Investing!