Grayscale Bitcoin Trust (GBTC), which began January 2021 with a holding of 619,000 $BTC, has seen a decrease to 478,000 BTC as of now. While Grayscale holdings dwindle, financial giants Blackrock and Fidelity have stepped into the scene, acquiring a staggering 134,357 BTC ($5.7 billion) for their respective Spot Bitcoin ETFs. This sudden increase raises questions about whether everyday crypto enthusiasts will even have access to Bitcoin if large institutions snap it all up!

Let us take a closer look at the state of the ETF race using 3 revealing charts:

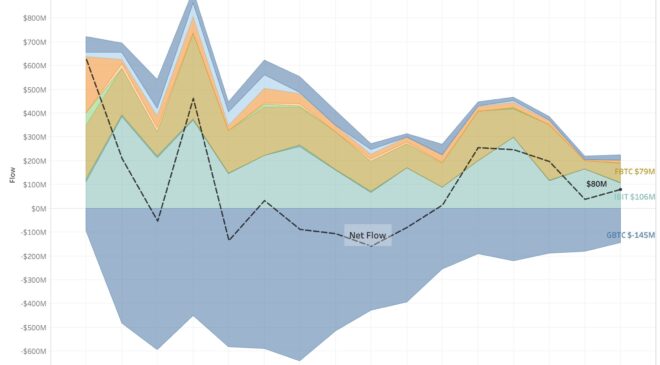

Consistently Positive Flows: With six straight days of positive net flows, Friday recorded an impressive $80 million injection, a clear indicator that demand remains strong despite recent dips in the Bitcoin price.

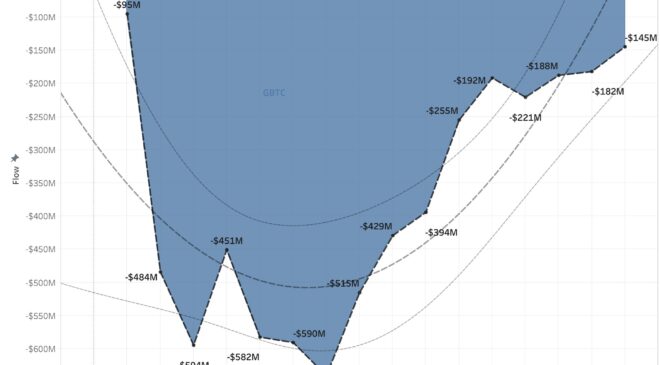

Slowing Down GBTC Outflows: After reaching peak negative territory earlier in March, GBTC outflows finally appear to be tapering off. On Friday alone, outflows slowed to just $-145 million, marking the smallest exodus since Day Two after launch.

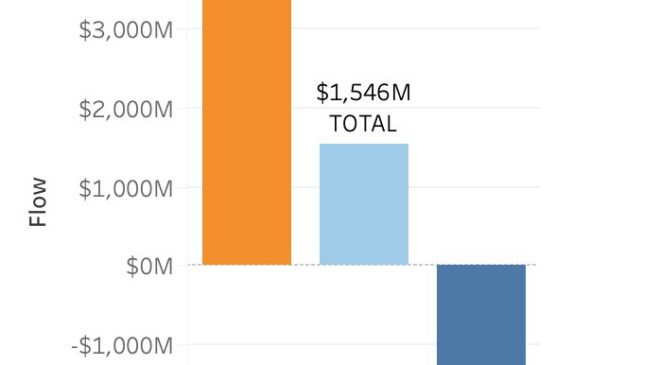

Cumulative Flows Over Time: Since the start, approximately $7.5 billion has poured into various Bitcoin investment vehicles while nearly $6 billion left through redemptions or other means. However, given that inflows can theoretically grow without bounds, one might wonder how long this situation can last before outflows reach exhaustion.

As you can see from our handy illustration below, cryptocurrency adoption shows a wide spectrum of participants ranging from small “shrimps” to larger ones (“whales”). Clearly, some of those big players are getting bigger!

While current events may seem alarming, remember that the Bitcoin network was designed precisely to handle heavy usage and increasing value over time. Furthermore, each uptick in institutional involvement adds legitimacy to the ecosystem, ultimately benefiting everyone involved.

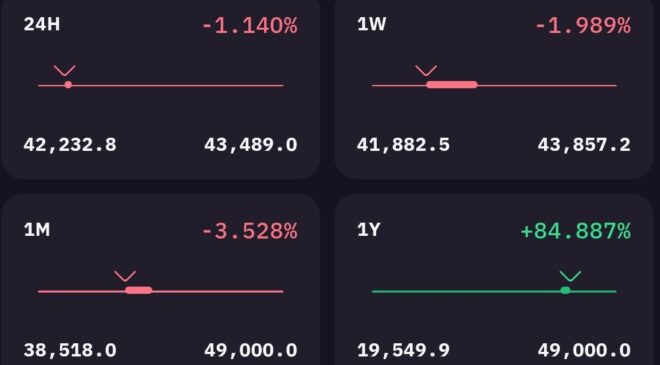

On another note, though Bitcoin’s price hovers around $42,400 – slightly lower than expected considering significant recent acquisitions – rest assured knowing that markets tend toward equilibrium. When supply decreases relative to demand, prices naturally rise until equilibrium returns.

So what does this mean for individual investors? Now more than ever, consider making consistent purchases part of your routine via dollar-cost averaging or similar methods. And above all, heed this sage advice: Stay humble. Stack Sats.