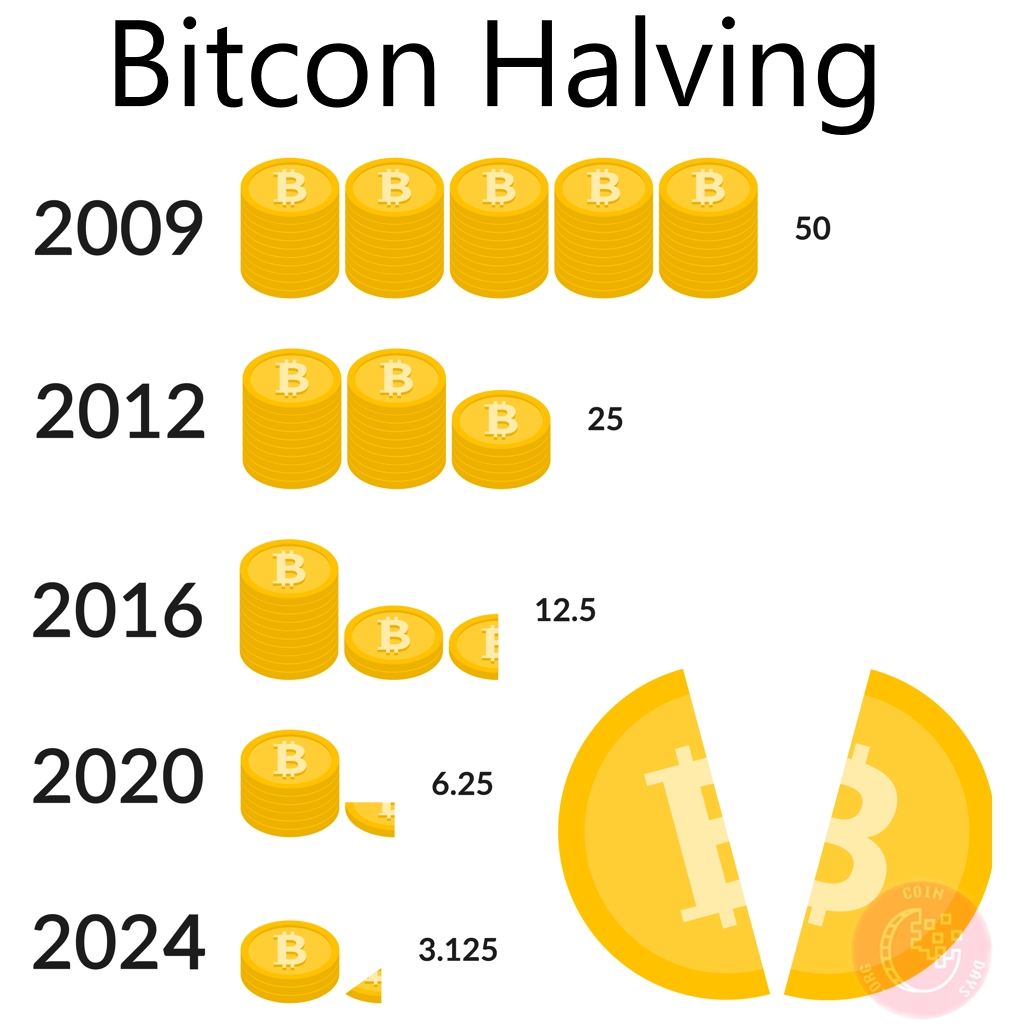

The Bitcoin halving, an event that occurs approximately every four years, has long been associated with price surges. It reduces the rate at which new Bitcoins are mined, creating scarcity and driving up the price. Historically, Bitcoin’s halving has triggered bull markets, pushing it to new all-time highs. This year, the anticipation is heightened due to the potential approval of a Bitcoin ETF, which could broaden investor engagement with the asset.

Bitcoin’s market share, currently at 54%, is the highest in over two years. This indicates a shift in investor focus back towards Bitcoin, attracted by its higher returns compared to other cryptocurrencies. There’s even speculation of Bitcoin gaining an additional 5% in market share, with the next resistance level at 58%.

The price recently broke above July 2023 highs, reaching a new 2023 high above $35,000. Though prices have stabilized, the upward trend persists, with traders anticipating further gains.

The derivatives market is also optimistic, with call options suggesting the next key test for Bitcoin’s price at the $40k level. A successful breach of this level could potentially pave the way for a return to Bitcoin’s all-time high.

As we approach the Bitcoin halving in late March or April 2024, there’s an expectation of new all-time highs. Historically, Bitcoin has experienced bull runs following halving events, making it an eagerly anticipated event among investors.

Related: Bitcoin halving countdown

However, a recent panel discussion asked whether the Bitcoin halving is truly a bullish event or merely a narrative. While most panelists agreed that the halving’s impact may be diminishing, they emphasized the importance of liquidity in influencing Bitcoin’s price.

In conclusion, while the Bitcoin halving remains a significant event, it’s not the sole determinant of Bitcoin’s price. Market dynamics, investor sentiment, and liquidity are increasingly playing crucial roles in shaping the cryptocurrency’s value. The next halving is eagerly anticipated, but its potential impact on Bitcoin’s price is subject to ongoing debate, making it an exciting topic for cryptocurrency enthusiasts and investors to follow.

Is the Bitcoin Halving Still a Price Catalyst?