Greetings, fellow Bitcoinners! It’s an exciting day in our beloved crypto space, as BlackRock and its peers take center stage in the quest for mainstream acceptance. As regulatory clarity emerges, institutional giants see new opportunities to bring Bitcoin closer to traditional finance while ensuring investor protection.

Larry Fink, the CEO of BlackRock, has recently expressed his views on Bitcoin, positioning it as a commodity instead of a traditional currency. This perspective highlights the significance of appreciating Bitcoin from an investment viewpoint, which is a notion that finds agreement among numerous individuals. On the other hand, El Salvador’s decision to recognize Bitcoin as legal tender reflects a different approach to embracing the best cryptocurrency.

As we navigate the evolving landscape of digital currencies, it becomes essential to strike a balance between speculative investments and sustainable growth. Institutions often attempt to maintain control over these assets; however, focusing on their potential utility and infrastructure development can lead to more enduring achievements for future generation.

Now let me share some intriguing updates that prove how quickly things are heating up in this arena! 🔥

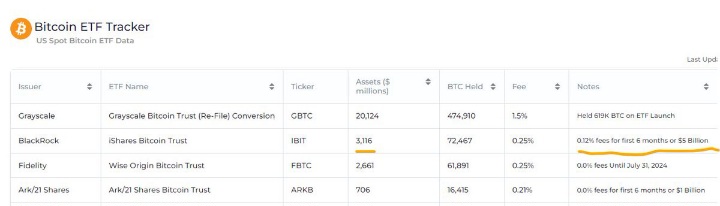

Major players such as BlackRock, Fidelity, Grayscale, Vaneck, Invesco, and Bitwise have entered the ring by advertising their Bitcoin ETFs (Exchange Traded Funds) via none other than Google Ads. This strategic move indicates a significant leap towards broader visibility and accessibility within the retail market segment.

To illustrate, BlackRock made headlines when offering a tempting discount – reducing fees down to 0.12% for initial investments up to $5 billion. And guess what? Just three short weeks later, they’ve already gathered a whopping $3 billion! If this trend continues, reaching that magic number could happen sooner than anyone anticipated.

But wait, there’s more! According to recent data, BlackRock alone has accumulated over 0.34% of the global Bitcoin supply, holding around 69,692 precious coins at present. Given another week or so, one wonders just how much further they’ll push those numbers!

So here’s my takeaway: Institutions aren’t merely dipping their toes in the water anymore. They’re making bold strides, investing heavily, and positioning themselves front and center during this pivotal moment. These actions speak volumes about where they believe Bitcoin is headed.

With each passing day, it becomes clearer that big-league involvement heralds a new dawn for digital assets. Exposure on platforms like Google ensures increased trust, credibility, and liquidity. Ultimately, this leads to greater stability, fostering healthier ecosystem growth.

Here’s to witnessing even more remarkable milestones along the road ahead.

Until next time, stay stoked and HODL tight!