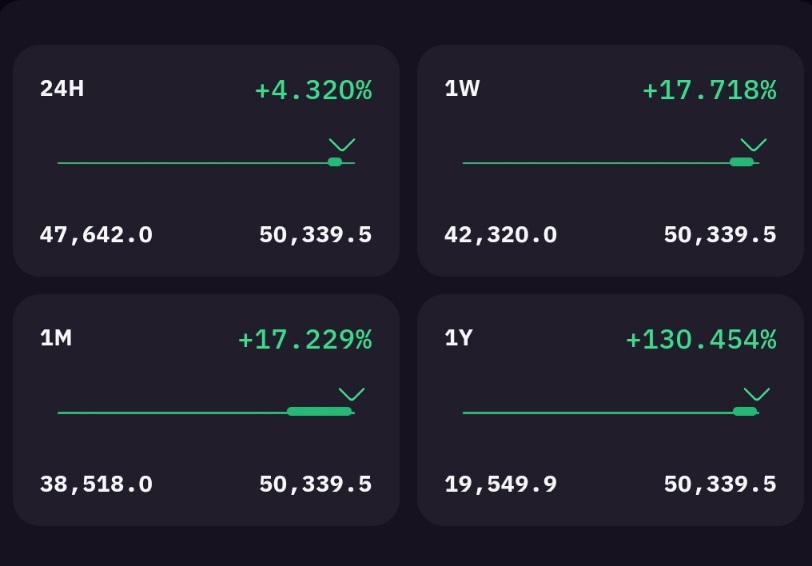

Excitement fills the air as Bitcoin price breaks past the much-anticipated $50,000 milestone! With increasing global adoption and recognition, let’s explore how this achievement impacts various countries experiencing economic challenges such as hyperinflation.

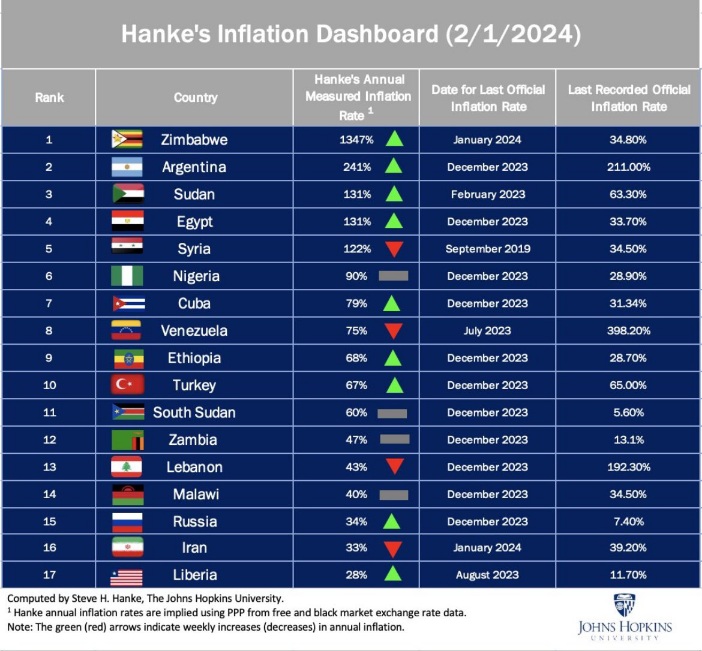

For millions of individuals living in Turkey, Egypt, Nigeria, Argentina, Lebanon, and Pakistan, the value of Bitcoin tells a different story compared to traditional fiat currencies. These six nations alone account for a staggering combined population of 700 million people, many facing volatile economies and soaring inflation rates.

Nigeria and Argentina are prime examples where Bitcoin prices have skyrocketed by more than double within just the past two months. Such dramatic increases reflect the desperate need for alternative stores of value, making Bitcoin increasingly attractive for those suffering under devalued national currencies.

Do you recall Twitter CEO Jack Dorsey’s controversial comments on hyperinflation in October 2021? Back then, Dorsey received criticism for his assertion that “hyperinflation is going to change everything. It’s happening,” which sparked heated debates across social media channels. However, recent events seem to validate his claims, particularly concerning emerging markets grappling with rampant inflation.

In response to Jack Dorsey’s inflammatory comment regarding hyperinflation, critics argued that it was unwarranted given the relatively low 5% inflation experienced in recent years. While they may argue semantics surrounding the definition of hyperinflation, current geopolitical tensions signal ominous signs for certain regions and their respective fiat currencies.

The ongoing military conflicts in Syria, Sudan, Ukraine, Palestine, Israel, Lebanon, among others, highlight the devastating consequences of warfare on property values, wealth preservation, and overall prosperity. Economic sanctions imposed on Russia due to its invasion of Ukraine exacerbate concerns related to energy pricing and the stability of reserve currencies. Meanwhile, Iran faces mounting political pressures to align itself with BRICS (Brazil, India, China, South Africa), posing additional threats to the dominance of the U.S. Dollar.

Considering these factors, it becomes apparent why alternatives like Bitcoin gain traction amid growing uncertainty in traditional financial systems. Boasting an impressive annual inflation rate of approximately 1.8%, coupled with diminishing supplies following each halving event, Bitcoin presents a compelling case for long-term investment. Indeed, the scarcity factor plays right into Bitcoin’s hands, positioning itself as a viable hedge against volatility brought forth by unpredictable international relations.

With only limited quantities left to mine before reaching maximum capacity, Bitcoin’s intrinsic deflationary nature ensures sustained demand while maintaining a stable supply. Consequently, this fosters confidence in prospective buyers seeking refuge from eroding purchasing power associated with conventional assets subject to quantitative easing measures and other forms of manipulation.

To summarize, the unique characteristics of Bitcoin distinguish it significantly from traditional assets like real estate. Its absolute scarcity creates a powerful deflationary force seldom witnessed elsewhere, setting the stage for remarkable price appreciation trends. Despite persistent arguments dismissing comparisons between Bitcoin and genuine instances of hyperinflation, the broader macroeconomic landscape suggests otherwise.

Geopolitical tension points worldwide fuel speculations regarding possible disruptions to established financial structures, thereby intensifying interest in reliable alternatives such as Bitcoin. Moreover, the anticipated shortage in Bitcoin supplies resulting from consistent reductions through halving events contributes to its rising valuation trajectory. Demand remains robust thanks to the cryptocurrency’s superior monetary attributes, ensuring sustainable appeal even amid crises.

Consequently, should hyperinflation materialize, Bitcoin holders stand poised to benefit immensely from the ensuing turmoil, serving as dependable sanctuaries throughout tumultuous phases, perhaps Dorsey wasn’t too far off base in predicting impending hyperinflation risks looming in the distance. Only time will tell if his prophetic words prove accurate; however, all indications point towards continued growth for cryptocurrencies like Bitcoin as safe havens during turbulent periods. So buckle up, dear reader, the ride promises to get bumpier yet still exhilarating!