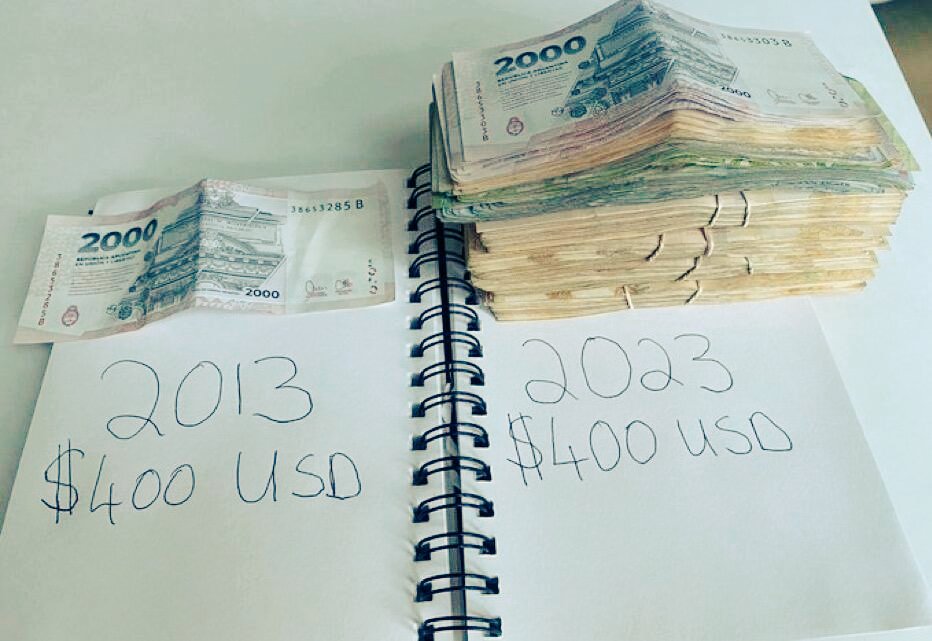

The Argentine peso has been in free fall, plummeting by 97% against the US dollar in just 10 years. This staggering devaluation has left many citizens struggling to make ends meet and has raised serious concerns about the country’s economic future.

In times of economic uncertainty, it’s essential to look for alternative store of values that can protect wealth and provide a hedge against inflation. One such option is Bitcoin.

As a decentralized digital currency, offers several advantages over traditional fiat currencies, including its limited supply, transparency, and security. While the value of the peso continues to slide, Bitcoin has consistently demonstrated its resilience and stability. In fact, it has outperformed most traditional assets in recent years, making it an attractive investment opportunity for those looking to safeguard their wealth.

Moreover, Bitcoin transactions are recorded on a public ledger called the blockchain, which ensures transparency and accountability. This means that unlike traditional currencies, which can be manipulated or printed at will by central banks, Bitcoin’s supply is fixed and cannot be altered. As Argentina continues to grapple with economic challenges, it’s time for individuals and institutions to consider alternative store of values like Bitcoin. By diversifying their portfolios and investing in BTC, they can not only protect their wealth but also gain exposure to a rapidly growing global market.

So, what are you waiting for? Join the Bitcoin revolution and secure your financial future today! 🚀